After a record climb between December and April, the market is cooling off again. May ended up being a bad month for a lot of sectors as the tariffs/trade war rhetoric picked up steam.

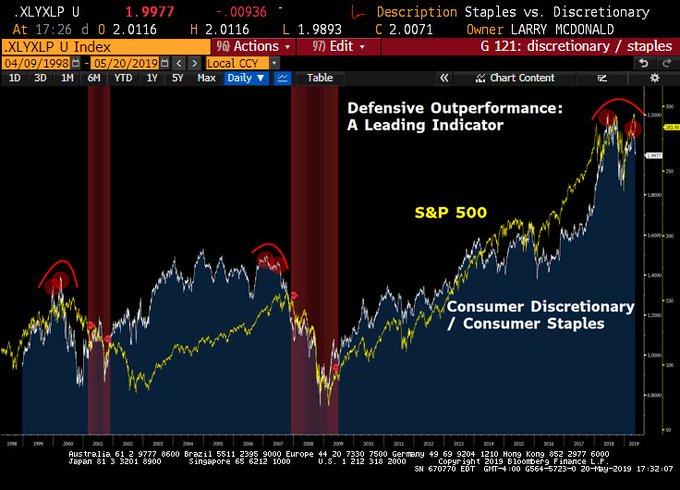

Not only is the US now targeting a trade war against China, but also Mexico — thats 2 out of 3 largest trading partners. Of course, investors are rushing to safe havens now, so treasuries & gold are doing well. Following graphic provides a quick overview of market sentiment at the end of May 2019.

Outlook for June 2019

The US bond market is pricing in about three rate cuts before the end of 2020. As a result, the treasury rates continue to weaken. Whether this will result in an actual recession is anyone’s guess at this time. I do not really intend to have any knee-jerk reaction as my portfolio is already setup to weather the storm if it comes our way.

However, I have been considering reducing my total number of holdings and concentrate on a smaller number of companies. Currently, our family portfolios have 25 individual stocks and 9 different funds. Some of the funds will have to stay the way they are, as the options in certain account types are limited — for e.g., I can only choose from a pool of certain seg funds in my work RRSP plan.

But on the individual stock front, I have full control…so I plan to sell off some of these companies and focus on a smaller group of companies. In addition, over the years I have ended up with lower quality of companies and sold off higher quality investments due to strength in the market. This is something that I am looking to correct as well. I am still in the process of creating a shortlist and will share details on this blog in the coming days of the path forward.

As of May 31, 2019 our portfolio is diversified as shown below.

Looking for investment ideas? Check out this Top Investment Picks for 2019, where 30+ investors present their top pick and a reason to invest in those securities.

I have also started putting together a series of posts for Investment Ideas, where I explore different ways of looking at companies and finding inspiration for further research.

What are your thoughts on the points mentioned above? Do you have any specific thoughts on the markets and looking at anything interesting? Are there any stocks that you believe is a strong conviction buy here? Share with a comment below.

Full Disclosure: Our full list of holdings is available here.

This article was written by Roadmap2Retire. If you enjoyed this article, please consider subscribing to my feed at Roadmap2Retire.com/feed