Summary

- GM has greatly improved its financial health and is back on “growth mode”.

- GM has eyes on the future to fuel its growth (electric & autonomous car).

- There are several clouds looming (competition, high debts, underfunded pension plans).

Are you ready to give it a second chance? This is often a question investors must ask themselves when they look at a company that already cut their dividend. Did management really understand what put them there in the first place? While General Motors (GM) has done a marvelous job at getting back from the dead, I’m not sure it can be qualified as a “safe dividend payer” yet. GM was once admired by many as the world’s #1 automotive constructor. After its fall in 2008-2009, the company worked very hard to bring its iconic brand to the top. It did a great job, but is it enough?

Understanding the Business

General Motors doesn’t need a presentation. Even my 6-year-old can tell the difference between a GM and a Ford since there are so many of their cars on the market. GM is not only a leader in the automotive industry, it is also a leader in the high-margin pickup truck sub-segment.

GM’s presentation

GM is obviously tied to the car industry and its cycles. After becoming a low leaner, it is now showing a breakeven point when production reaches around 10-11 million units. The company counts on less brands and more productive processes. GM has switched from an old model where it used to overproduce some models and shove them through consumers’ throats to a business model where it produces what clients want and meets the demand instead of exceeding it.

Growth Vectors

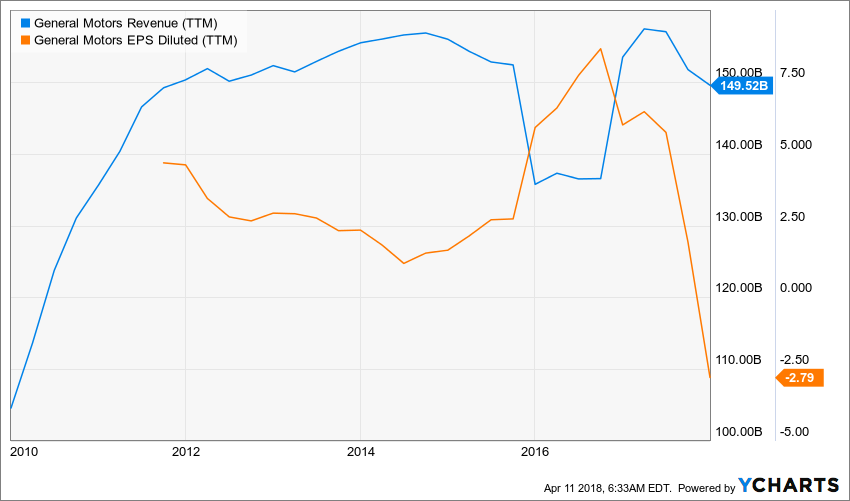

Source: Ycharts

GM counts on its leadership in the pickup truck segment to boost its cash flow in the upcoming year. The demand for such vehicles remains robust and offers growth possibilities for the years to come. It seems that everybody wants to drive a pickup these days! China and other emerging markets are obviously stable a growth vector for the automotive constructor.

Now that the company is back on track with stronger financial results, it has an eye on the future. This is a future with electric and autonomous cars. Two very intriguing, yet promising segments.

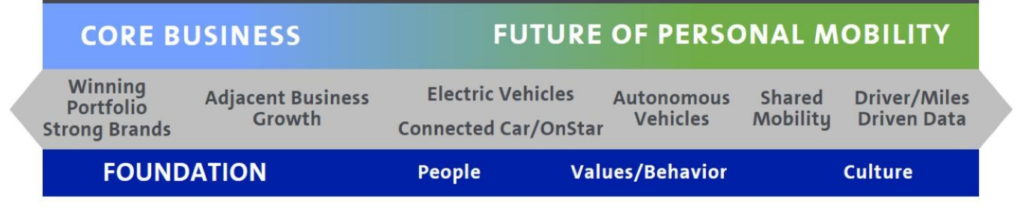

Source: GM’s investors presentation

As the population grows and move toward urban areas, the desire of driving their Corvette with their hair in the wind, is being replaced by low gas consumption transportation. Even better, if people can start working early in their car and don’t have to mind traffic while commuting to work, they’ll go for an autonomous electric car. This was pure Sci-fi a few years ago, but now we have a feeling that GM could possibly be among the pioneer in this sector.

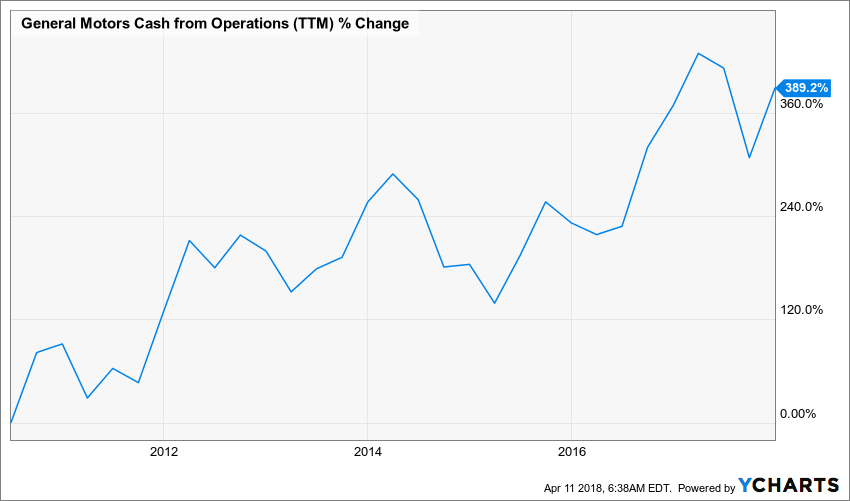

Source: Ycharts

GM has made gigantic steps in improving their cash flow generation abilities. As a dividend investor, I’m also pleased to see that management used $25B for its shares repurchase program (GM bought back 25% of outstanding shares) along with its dividend payments. Speaking of which…

Dividend Growth Perspective

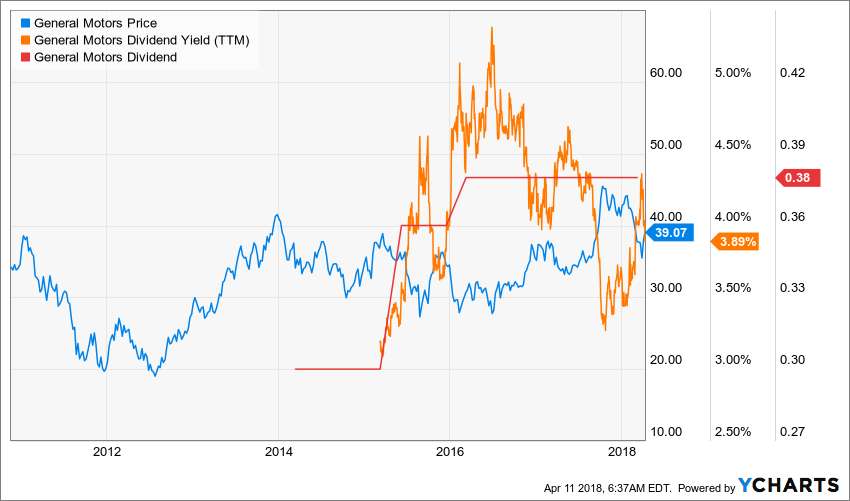

GM reinstated its dividend payment in 2014 and has increased it twice since then. We are not talking about a super-powered dividend grower. To be honest, there are tons of Dividend Achievers I prefer before picking GM. You can get the full list here.

Source: Ycharts

At a 3.5%-4% dividend yield, GM could please income seeking investors such as retirees. GM dividend brings back good old memories spent of summer vacation in an Oldsmobile. However, we are far from driving on that highway right now.

Source: Ycharts

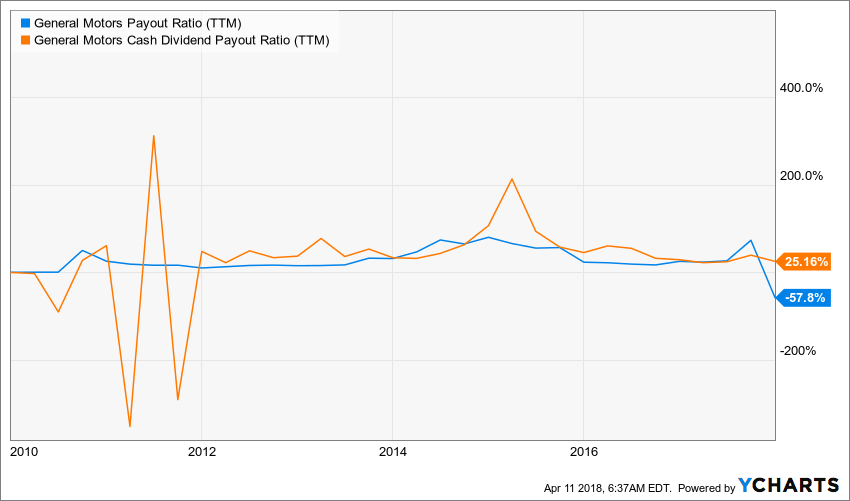

As previously mentioned, GM has seriously improved its cashflow generation abilities and that shows through its cash payout ratio. Before the tax bill changes short term EPS, GM’s payout ratio was also well under control. While GM tries to seduce investors with shares buyback programs and juicy dividend, I expect low-single digit growth for the future. As you are going to see in a moment, GM has other cash flow priorities.

Potential Downsides

GM obviously counts on its strong reputation and brand awareness to sell more cars. However, I doubt this will be enough going forward. The competition is fierce, and consumers are already loaded with car debts. There is a limit in refinancing their old car with a new one.

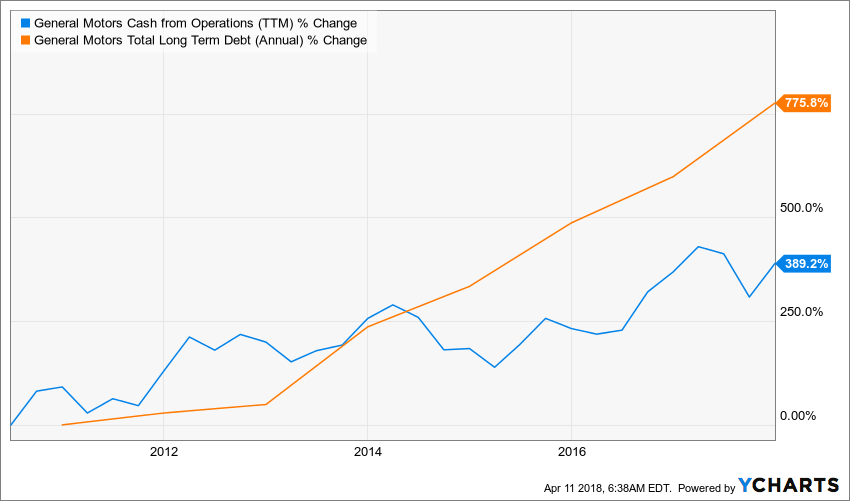

Developing, manufacturing and marketing cars is a capital-intensive business. It becomes even more expensive when you are going outside the box and go with new technology (electric/autonomous). While GM’s cash flow from operation is skyrocketing, its debts are also raising fast.

Source: Ycharts

Such high debt will need to be paid at one point in time. As long as the global demand for cars remains stable, this is not a problem. However, an economic downturn could quickly get GM back on its heels. Don’t be too quick to forget about 2008 disaster. GM is not out of the woods yet.

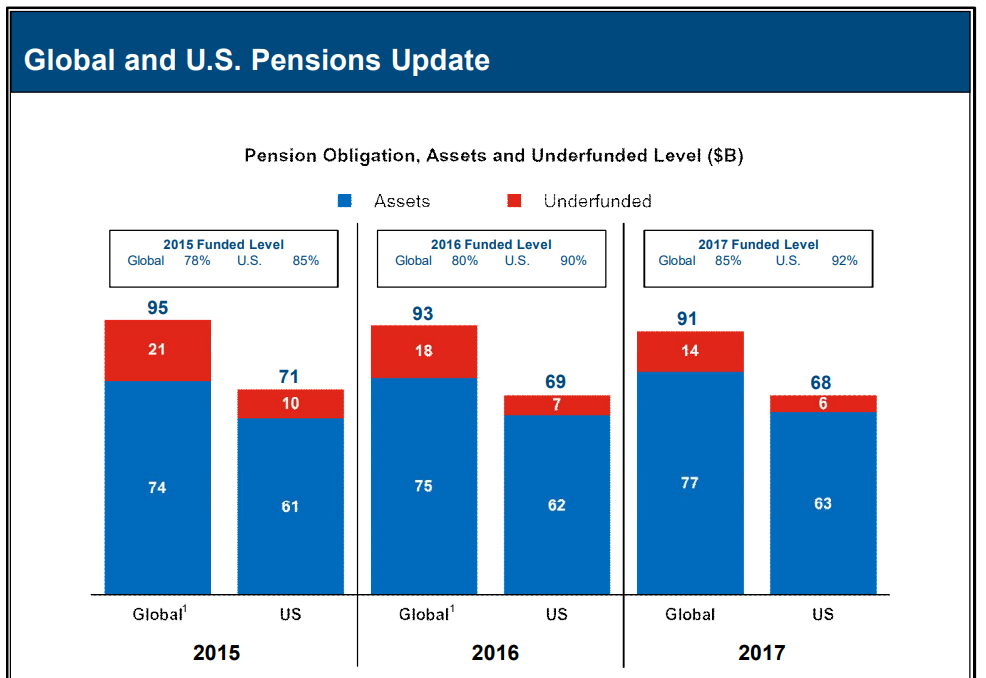

Finally, GM is still dragging substantial pension funds expenses. In their Q4 2017, the company estimated its pension funds underfunded debt to be around $14 billion. This is not pocket change.

GM Q4 2017

Valuation

Assessing the value of a company that went through so much over the past decade is quite a challenge. In fact, the problem is that there are absolutely no trends here:

Source: Ycharts

The PE valuation is completely useless as GM went up and down and completely transformed its business over the past 10 years. Now, using the Dividend Discount Model is also a big guess as we have limited dividend history and lots of assumptions to take into consideration.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.52 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 3.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 3.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $31.31 | $26.84 | $23.48 | |

| 10% Premium | $28.70 | $24.60 | $21.53 | |

| Intrinsic Value | $26.09 | $22.37 | $19.57 | |

| 10% Discount | $23.48 | $20.13 | $17.61 | |

| 20% Discount | $20.87 | $17.89 | $15.66 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Since GM hasn’t increase its payouts since 2016, I can’t go crazy with the dividend growth rates. I decided to stick to 3% going forward. I also used a 10% discount model mainly because GM could fact many headwinds going forward.

Final Thought

I don’t think GM shares will fall by 40% this year. However, the DDM calculations show me there is no deal in buying GM today. That’s too bad because I like that the company is going toward electric cars. I really hope they succeed as a consumer, but I’ll pass as an investor.

Disclaimer: I do not hold GM in my DividendStocksRock portfolios.

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]