Continue Reading »

Recent Posts From DIV-Net Members

-

Wal-Mart Stores, Inc. (WMT) Dividend Stock Analysis - Linked here is a detailed quantitative analysis of Wal-Mart Stores, Inc. (WMT). Below are some highlights from the above linked analysis: Company Descripti...19 hours ago

-

Do I Need Fixed Income? - *Even so spoke the old farmer to his son: A cow for her milk, a hen for her eggs, and a stock, by heck for her dividends. An orchard for fruit, bees for...2 days ago

-

How To Have a Productive Day: 7 Step Morning Routine - Better Daily Habits To Get More Done By adopting an effective morning routine, you increase the odds of having a productive day. Build these seven easy s...3 weeks ago

-

Qualcomm Dividend Increase - On 18 March, Qualcomm (QCOM) increased its dividend by 4.71%, from 85¢ to 89¢ per share. This dividend increase will be effective for quarterly dividend...3 weeks ago

-

Moving to Substack - Dear Readers, This will be my last post on WordPress. I have decided to move my blogging content over to Substack. WordPress has been the home for my blog ...3 months ago

-

January 2025 Net Worth $2,102,033 - Hey Everyone and welcome to our January 2025 net worth update. We’re at $2.102 million, up over $7k in what was a pretty subdued month for our investment...3 months ago

-

Q4 2024 Dividend Income Update - As 2024 comes to a close, it’s time to reflect on what has been a phenomenal year for investors. The S&P 500 delivered an exceptional year-to-date return...3 months ago

-

Vacation Rental Report – Emerald’s Corner – May 2024 - Another month has gone by and now it’s time for me to write the vacation rental report for Emerald’s Corner for May 2024. I recently posted the Calypso M...10 months ago

-

Introducing Wall Street Data Solutions, a revoluti... - Introducing Wall Street Data Solutions, a revolutionary platform designed to empower traders with real-time market insights, expert analysis, and personali...1 year ago

-

2022 Week 46 investing and trading report - I feel like the markets are easing their bearish stance. They are still extremely volatile and choppy intraday, but we are poised for a rally that may la...2 years ago

-

Portfolio Update – March 2021 – $1,000 per month! - I am a little shocked, and disappointed in myself, that it has been almost eight months since my last post. The timing makes sense though: I went back to s...3 years ago

-

Passive Income for July 2020 - Once a month, I like to talk about my total passive income for the previous month. I do this to track how much passive income is coming in. When I start ...4 years ago

-

Portfolio Update May 2020 - It is time to give a new update about my current portfolio. April has shown some recovery of my portfolio and also of my dividend … The post Portfolio Up...4 years ago

-

Screening for Dividend Stocks Selling at a Discount - Note: This page contains affiliate links for certain services and products. I may receive compensation at no additional cost to you when you click on th...5 years ago

-

Cardiovascular Systems - Cardiovascular Systems, Inc., a medical technology company, develops, manufactures, and markets devices to treat vascular diseases in the United States. Th...6 years ago

-

Portfolio Report December 2016 - Ending a mixed year for my portfolio. I sold some high-yield, but dividend cutting and poor performing stocks. I picked up my first monthly div payer, O...8 years ago

Recent Buy – CRZ

My first purchase of 2018. It didn’t take me too long for the first purchase, even though I was hoping to wait until things cool down a bit. However, when dealing with a high momentum sector, its better to “go with the flow” instead of sitting on the sidelines and regret missed opportunities.

Continue Reading »

Labels:

Roadmap2Retire

All Investing Involves Risk

If your goal is to accumulate wealth for a comfortable retirement, then there is no risk-free path. Throughout time every angle has been tried and failed. However, some approaches carry less risk than others. Let's consider some of the popular paths.

Continue Reading »

Continue Reading »

Labels:

Dividends4Life

Weekend Reading Links - February 25, 2018

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Continue Reading »

Labels:

Links

It’s Never Enough When It’s Apple

Summary

- Apple just finished another record year

- Haters gonna hate

- Shareholders gonna smile

I remember the first time I purchased shares of Apple (AAPL). At first, it was supposed to be a short-term investment as there was a timely opportunity. I bought my first shares before the split, when the stock was trading under $400 (therefore, under $57 after the 1:7 split). At that time, many rumors were going around.

“Apple’s iPhone is going to be eaten-up by Samsung’s smartphone”“The company is a one trick pony”“We have reached Apple’s full potential; it will only go down from now on”

A few years and over 100% return later, Apple is struck by similar bad mouth sayings.

“The iPhone X is a failure”“Apple’s battery sucks”“The company is programming smartphones obsolescence, Apple is evil”

It’s funny to see that for each Apple fan, there is probably a hater. It’s only fair. But as a serious investor, you should neither be a fan or a hater. Emotion has no place when it’s time to take a look at a stock. Now that we have set our feelings aside, let’s take a deeper look at Apple.

Continue Reading »

Labels:

Dividend Monk

Recent Sell – Seg Funds

This is part of my annual sale in my employer-offered retirement matching plan. As part of the employment compensation package, I am encouraged to contribute to a group retirement plan, to which my employer matches 50% of the funds. The catch was that I had to choose from a pool of segregated funds offered by an insurance company. These funds come with high management fees but in order to not leave money on the table, I decided to make regular contributions. I originally documented it in this post.

Continue Reading »

Labels:

Roadmap2Retire

4 Dividend Stocks With Room To Increase Their Payout

I currently track over 200 dividend growth stocks in my D4L-Database and have determined some of the lower rated stocks could be buys if the companies simply chose to increase their dividends. For various reasons their management has elected keep a low payout ratio and deploy the excess cash elsewhere.

Continue Reading »

Continue Reading »

Labels:

Dividends4Life

Weekend Reading Links - February 18, 2018

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Continue Reading »

Labels:

Links

Diageo: Shiny Bottles Lead to Shiny Dividends

Summary

- Diageo is a leader in premium spirits industry, it will surf the current economic tailwind.

- Emerging markets start to get some traction as middle class seeks recognitions and claim a higher status through their lifestyle.

- Unfortunately, DEO is overpriced right now.

Investment Thesis

DEO will benefit from the good standing of the current economy. Consumers around the world are optimistic in their future, and they are more willing to spend. DEO enjoys strong pricing power, and its brand portfolios are protected with premium names. Diageo also invests in an important sales team in order boost its product’s popularity at all times. The company will continue to pay a solid 2.50% dividend. Finally, the rising income in emerging markets will eventually lead to additional customers for Diageo and its premium spirits. Unfortunately, the DDM calculation doesn’t justify the current price.

Continue Reading »

Labels:

Dividend Monk

BUD-WEIS-ER, Frogs & Fuss Aren’t Enough for Me to Drink

Summary

- After its merger with SAB Miller, Anheuser-Busch InBev has proven to the world that it will “own the beer market” across the world.

- The company is dominant in many countries with 50%+ market share in Brazil, Latin America and Belgium.

- Unfortunately, the dividend perspectives don’t justify the current price.

Investment Thesis

Do you remember those BUD-WEIS-ER frogs in the company’s commercial a long time ago? I’m not sure I was old enough to drink beer back then but I surely enjoyed the frogs. In fact, Anheuser-Busch InBev (BUD) always had this magic touch to create viral ads. Over the years, the beer maker has expanded its brand portfolio to the limit of the world.

BUD is a leader in a stable market that is not ready to decrease. The company is producing over 500 million of hectolitres (as compared to 204 million for Heineken) and enjoys economy of scale. The brewer will continue to grow through acquisitions and will also increase its presence in emerging market, notably in China. BUD is a solid dividend payer with a 3.50% yield offering income seeking investors the opportunity to invest in a well-diversified company. Unfortunately, BUD seems overvalued at this time.

Continue Reading »

Labels:

Dividend Monk

Top Investment Picks for 2018

As the new year rolls out, its time to share the annual investment pick contest that I run. This is the 3rd year in the running. This is merely meant to be a fun experiment to run and collect top investment picks for 2018 from a community of investors I regularly interact with. There are still some great picks from the 2016 & 2017 top picks, and I invite you to check them for ideas. Remember that investing is a long game — so, focusing on short intervals like a year is not prudent — even though this contest focuses on one year return. Plenty of older picks may still present long term value.

The rules were simple: Pick one investment (stock, bond, fund, commodity, cryptocurrency or any other form of investment security), and present a short & quick investment reason behind the pick. I will track this progress over the year and provide quarterly updates on this blog.

Top Investment Picks for 2018

Before I present the picks, I would like to remind the readers that these are simply picks based on current outlook and each investor should not take this as investment advice. If you decide to pursue these investments, please do your due diligence before investing in any of the securities mentioned.

Without further ado, here are the top picks from the investing community for 2018.

All About the Dividends: Bank of America Corp (BAC)

“The bank’s financials continue to recover after the financial crisis, with rising interest rates forecasted next year I think investors will see more stock buybacks and dividend increases.”

Angry Retail Banker: AT&T Inc (T)

“I’ll go a bit more conservative than everyone here and say $T. Last I checked, the dividend for AT&T was pushing 6%. People are overreacting to the pushback on the Time Warner deal. It’s still a great business with a strong legacy and steady cash flow. The only real problem is its debt, but either the deal goes through and that extra cash flow pays down the debt, or it doesn’t go through and they don’t take on that extra debt. Either way, AT&T is an amazing and safe company that’s yielding in the high 5%’s, and it’s one of the rare exceptions to the time tested rule of avoiding high yielding stocks due to their danger.”

Arbor Investment Planner: Gamestop Corp (GME)

“As a deep value investor I like to buy companies that are completely out of favor. Investors believe GME is Blockbuster Video, but I believe they are wrong. This stock is priced as if GME will eventually go bankrupt. However, management has been preparing for declining revenues by diversifying and preparing for future growth. In the meantime they are generating tons of cash flow and sell at a bargain basement price of 3.3 EV/EBITDA, a 14% Free Cash Flow Yield, and a dividend yield in excess of 8.4% at the current price of $18.07.”

David Brady: Silver

(no reason provided)

Dependable Dividends: UEX Corp (TSE:UEX)

“I’m repeating my pick from last year. Obviously, UEX doesn’t represent the safe, dividend growth type stocks I usually write about. But seeing as this is a stock picking competition, I always like to swing for the fenses. Last year, UEX performed good enough to earn me a 7th place finish. This year, I think it could get me to the top of the pack… or dead last.Mr. Market has still priced uranium irrationally low. Spot rates still sit below the industry’s cost of production. That means miners lose money on every pound of uranium they haul out of the ground and make it up in volume. This situation is clearly not sustainable. As we saw last year from Cameco, miners will cut production, supplies will tighten, and uranium prices will slowly rise. That could send beaten down names like UEX soaring.”

DGIfortheDIY: Exxon Mobil Corp (XOM)

“I’m bullish on crude in 2018, as I think this run to $60 is just the beginning. XOM shares haven’t really participated in the run-up yet like CVX has, so I think there is some catching up to do. XOM isn’t as levered to the price of oil as some other smaller E&P’s, but the risk/reward at a 3.7% is compelling.”

This article was written by Roadmap2Retire. If you enjoyed this article, please consider subscribing to my feed at Roadmap2Retire.com/feed

Continue Reading »

Labels:

Roadmap2Retire

High-Quality, Low-Risk Dividend Stocks

To a large extent we are a product of our environment. Our life experiences not only shape out behavior, but at its very core, they shape our thought process. The Great Depression forever changed a generation of people. It appears the 2008-2009 financial crisis (Great Recession) may be having a similar effect on another generation.

Continue Reading »

Continue Reading »

Labels:

Dividends4Life

Weekend Reading Links - February 4, 2018

For your weekend reading pleasure, the articles listed below contain some of the best dividend and value investing insights found on the web. They were written by various members of the Dividend Investing and Value Network over the past week:

Continue Reading »

Labels:

Links

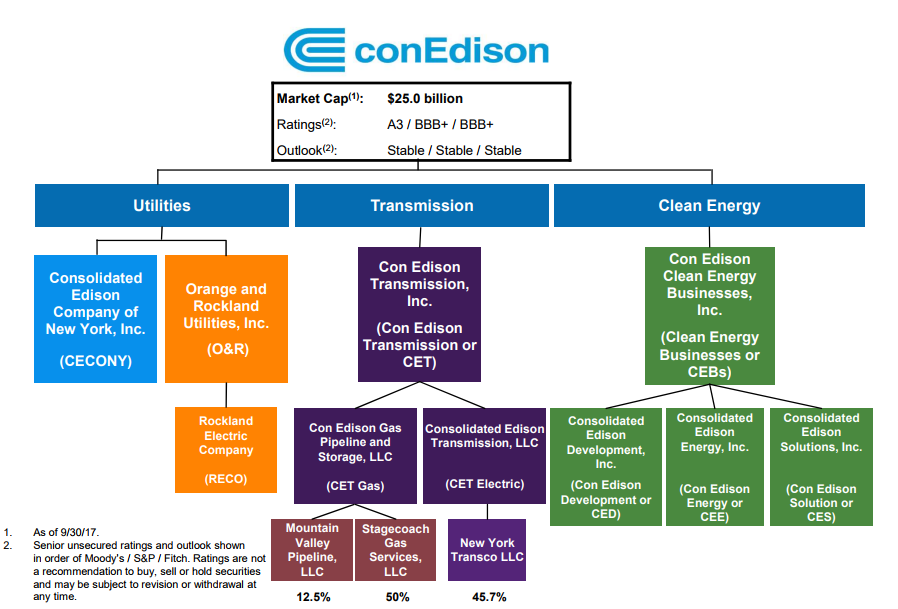

Consolidated Edison – Great Utility, Very Bad Price

Summary

#1 Consolidated Edison is a classic play in the utility sector with growth vectors in the natural gas distribution business.

#2 ED shows 43 consecutive years with a dividend increase making it a dividend aristocrat.

#3 While the company and its dividend are solid, the stock is definitely overvalued.

Over the past 30 days, Consolidated Edison’s (ED) stock has been evolving in red territories. The utility company shows a loss in value of about 10% between December 2017 and January 15th 2018. After a fabulous run in the current bull market, most utilities are slowing down. I think it’s time to take a look at Consolidated Edison to see if the current stock drop is a buy opportunity.

Understanding the Business

Consolidated Edison is a classic utility company operating in the New York State. It operates under 4 different segments:

Electric (71% of revenue)

Gas (14% of revenue)

Steam (5% of revenue)

Non-Utility (10% of revenue)

November ED presentation

While the chart above shows a whole segment for clean energy, the company generates only 4% of its revenue from this business segment. The core business remains it regulated utilities activities with 93% of its revenues.

Continue Reading »

Labels:

Dividend Monk

Subscribe to:

Posts (Atom)