Walgreen Co. (WAG), together with its subsidiaries, engages in the operation of a chain of drugstores in the United States. The company’s drugstores sell prescription and non-prescription drugs, and general merchandise. Walgreen is a dividend aristocrat which has paid uninterrupted dividends on its common stock since 1933 and increased payments to common shareholders every year for 36 years.

The most recent dividend increase was in July 2011, when the Board of Directors approved a 28.60% increase in the quarterly dividend to 22.50 cents/share. Walgreen’s largest competitors include Wal-Mart (WMT), CVS Caremark (CVS) and Rite-Aid (RAD).

Over the past decade this dividend growth stock has delivered an annualized total return of 1.40% to its shareholders.

The company has managed to deliver a 10.50% annual increase in EPS since 2001. Analysts expect Walgreens to earn $2.62 per share in 2011 and $2.99 per share in 2012. In comparison Intel earned $2.12 /share in 2010. The company has managed to consistently repurchase 0.50% of its common stock outstanding over the past decade through share buybacks.

The return on equity has decreased to 14.50% after reaching a high of 19% in 2007. Rather than focus on absolute values for this indicator, I generally want to see at least a stable return on equity over time.

The annual dividend payment has increased by 17.30% per year over the past decade, which is higher than the growth in EPS.

A 17% growth in distributions translates into the dividend payment doubling almost every 4 years. If we look at historical data, going as far back as 1980, we see that Walgreen’s has actually managed to double its dividend every five years on average.

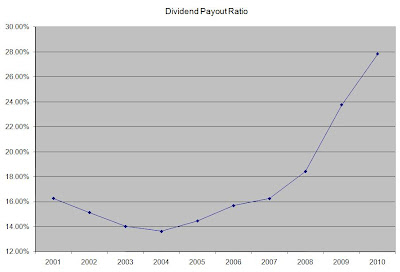

The dividend payout ratio has doubled from 16% in 2001 to 30% in 2010. The reason behind this increase was the fact that dividend growth exceeded earnings growth over the past decade. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Currently Walgreen’s is trading at 13.90 times earnings, yields 2.50% and has a sustainable dividend payout. The company rarely yields more than 2.50%, so I view the current weakness in the stock price as a good opportunity to add to my position.

Full Disclosure: Long WAG

This article was written by Dividend Growth Investor. If you enjoyed this article, please subscribe to my feed [RSS], or have future articles emailed to you [Email] or follow me on Twitter [Twitter].

Dividend Aristocrats List for 2026

-

The S&P Dividend Aristocrats index tracks companies in the S&P 500 that

have increased dividends every year for at least 25 years in a row. The

index is ...

22 hours ago