Summary

#1 Nucor shows 45 consecutive years with a dividend increase.

#2 Nucor is the largest steel producer and recycler in the U.S.

#3 The stock lags the market, but it’s not enough to convince me to pull the trigger.

Investment Thesis

Nucor (NUE) is a fascinating company. It is one of the rare basic materials company to show stability in a volatile environment. Nucor is a leader in the steel industry and it is also a dividend aristocrat with 45 consecutive years with a dividend increase. With the Trump administration’s plan to invest massively in infrastructure in the upcoming years, NUE will be among the first company to benefit from this tailwind. Unfortunately, the stock lagged the market in 2017 and it is still overvalued in my view. Let’s dig deeper to see if NUE fits your portfolio.

Understanding the Business

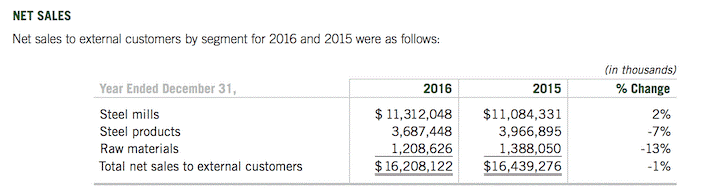

Nucor is the largest producer of steel in the U.S. The company, showing a production capacity of 27 million tons each year, is also the U.S. largest recycler. NUE operates 200 facilities and employs 23,900 workers. Their main business is their steel mills with 70% of their net sales. NUE also sell steel products (23%) and raw materials (7%).

Source: Nucor 2016 Annual Report

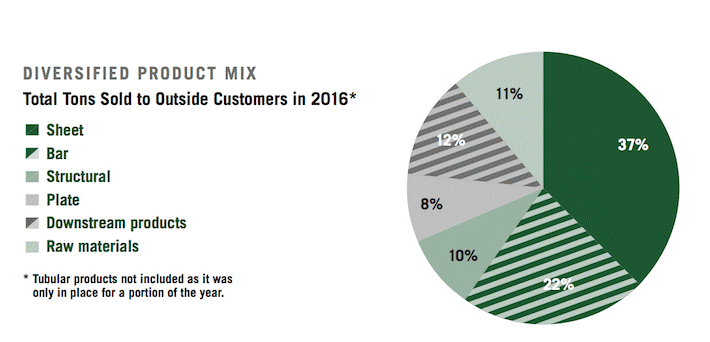

If you wonder what steel mills produce, here’s an idea coming from last year’s performances:

As you can imagine, Nucor’s financial performances are highly dependent on the price of its main commodity. As emerging markets’ (especially China) appetite for steel has diminished (there is a limit of ghost towns China could built!), it has been a rough couple of years for any basic materials company.

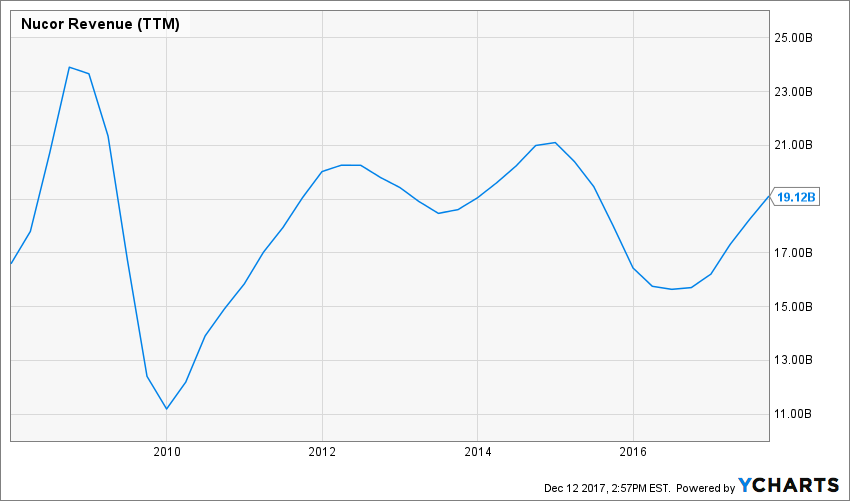

Revenues

Source: Ycharts

After two difficult years, NUE is on pace to show impressive growth. During their latest quarter, the company reported a +20.5% revenue increase year-over-year. This was good news as sales didn’t increase due to a stronger commodity price, but rather because Nucor produced more steel.

One of Nucor strengths remains in its wide variety of products. This enables NUE to meet clients demand in various markets and enjoy a more stable revenue stream compared to its peers.

Earnings

Source: Ycharts

Management is well aware of its variable profitability level according to steel price. It worked on this issue by going into a natural gas drilling program partnership with Encana (ECA). Nucor uses electric furnaces as opposed to blast furnaces (like 70% of steel producers). Having a direct link to natural gas drilling is a key component in their business model. Through the acquisition of David J. Joseph, one of the largest ferrous scrap metal brokers in the U.S., it also reduced pricing volatility.

In the upcoming years, NUE may benefit from Trump’s infrastructure program. As a classic way to stimulate the economy, the Trump administration has the intention of investing massively to improve their current infrastructure. This will automatically raise the demand for steel product. What best company than the largest steel producer to profit from this situation?

Dividend Growth Perspective

Management’s commitment toward its shareholders is quite obvious. With 45 consecutive years with a dividend increase, Nucor is among the rare basic materials company to rank among the dividend aristocrats and dividend achievers. The Dividend Achievers Index refers to all public companies that have successfully increased their dividend payments for at least ten consecutive years. At the time of writing this article, there were 265 companies that achieved this milestone. You can get the complete list of Dividend Achievers with comprehensive metrics here.

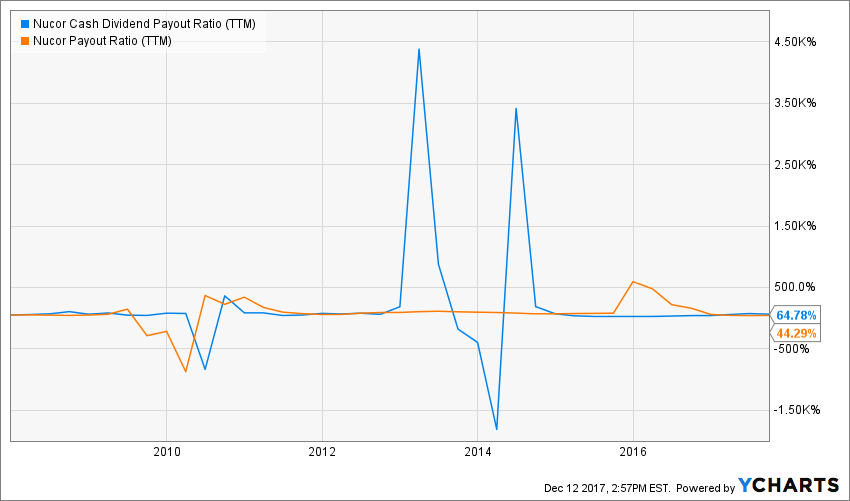

Source: Ycharts

Being able to increase its dividend for such a long streak is quite a feat considering the highly volatile market NUE has to deal with. Unfortunately, we are not talking about a strong dividend grower. The company paid a quarterly dividend of $0.3675 five years ago and we are now at a $0.38/share. I appreciate the stability, but once I’ve finished my plate, I’m still hungry!

Source: Ycharts

As you can see, Nucor’s mediocre dividend growth rate doesn’t come from business difficulties, but rather because management must deal with a highly cyclical environment. It’s not rare to see one of the payout ratios to bust completely off chart. Nucor does meet my 7 dividend investing principles, but I’m not excited about its dividend growth perspective.

Potential Downsides

While it’s nice to be the largest player in the U.S., Nucor is also limited to this market. In fact, NUE activities are concentrated solely in its country. This make Nucor dependant on both steel price and the U.S. economy.

I truly admire the company for making numerous efforts to become greener and also to preserve its workforce during tougher periods. However, this is another factor that reduces the company’s ability to increase its dividend in a significant way. As you will see in the upcoming section, there is no interest in buying NUE at the current price. It’s not like the company is about to surge and management will remain cautious with its dividend policy.

Valuation

It is never easy to put a dollar value on a company that evolves through a highly cyclical environment. The company valuation goes up and down like a roller coaster. However, many investors are willing to be patient due to Nucor’s solid business model and reputation.

Source: Ycharts

Therefore, the use of the PE history is useless in this case. A PE of 18 doesn’t tell me much about the current situation. When I use the Dividend Discount Model, I don’t get concluding results either. I’ve used a 3% dividend growth rate for the first 10 years and increased it to 4% afterward.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $1.52 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 3.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 4.00% | |||

| Enter Discount Rate: | 9.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 8.00% | 9.00% | 10.00% | |

| 20% Premium | $43.71 | $35.07 | $29.31 | |

| 10% Premium | $40.06 | $32.15 | $26.87 | |

| Intrinsic Value | $36.42 | $29.23 | $24.43 | |

| 10% Discount | $32.78 | $26.31 | $21.99 | |

| 20% Discount | $29.14 | $23.38 | $19.54 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

I really don’t think NUE will drop to $30 any time soon. In fact, this doesn’t really reflect the true value of the company. However, I can find interesting picks in this market using similar numbers. What the calculation tells me is that NUE should not be part of my portfolio as there isn’t enough growth vector to support such valuation.

Final Thought

When I noticed that this aristocrat lagged the market for over a year, I really hope to find a hidden gem. Unfortunately, there are good reasons why the company lags behind everybody else. While Nucor shows a robust business model, its growth perspectives are limited and its dividend growth isn’t enough to make me pull the trigger. Sorry, but I’ll pass

Disclaimer: I do not hold NUE in my DividendStocksRock portfolios.

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]

This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]