Summary:

PG’s brand cutting plan will start to pay off in 2016 with stronger earnings.

The brand portfolio and distribution network improvements show better than expected results so far.

The recent stock price drop brings the yield to 3.50% and makes the company very interesting to buy.

DSR Quick Stats

Sector: Consumer Defensive

5 Year Revenue Growth: -0.68%

5 Year EPS Growth: -2.82%

5 Year Dividend Growth: 7.56%

Current Dividend Yield: 3.51%

What Makes Procter & Gamble (PG) a Good Business?

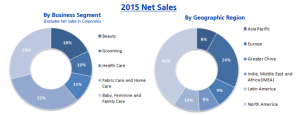

Procter & Gamble (NYSE:PG) is one of the largest and best-known companies in the world. It operates in over 180 countries, and the company has divided its widely-diversified operations into 5 divisions:

(Source: PG Investor Relations)

The company had made the decision to cut its brand portfolio and “reshuffle” its product categories for a better focus. They now have 10 products categories (baby, feminine, family, fabric, home, hair, skin & personal care, grooming, oral and personal health care) that include 65 brands.

Since the global economy is slowing down and the USD is strengthening every day, the company has focused heavily on improving its productivity over the past three years. This focus will result in $7 billion saved between 2012 and 2016 (expected) (source: PG investor presentation). They have made important efforts to simplify their distribution channels as they show in their presentation:

Ratios

Price to Earnings: 29.16

Price to Free Cash Flow: 18.45

Price to Book: 3.332

Return on Equity: 12.25%

Price to Free Cash Flow: 18.45

Price to Book: 3.332

Return on Equity: 12.25%

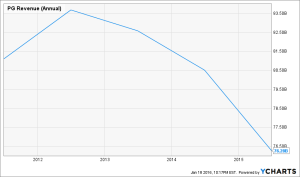

Revenue

Revenue Graph from Ycharts

Changing major brand management is being done without hurting results. The company shows lower revenue volumes over the past three years for two good reasons: #1) PG is exiting underperforming brands. While this has a positive effect on profitability, the gross sales numbers are down. #2) the company makes 41% of their sales in North America, the rest of their sales are in foreign currencies. The currency impact on the September 30th closing quarter was -9% and ***** on December 31st closing quarter.

How PG fares vs My 7 Principles of Investing

We all have our methods for analyzing a company. Over the years of trading, I’ve been through several stock research methodologies from various sources. This is how I came up with my 7 investing principles of dividend investing. Let’s take a closer look at them.

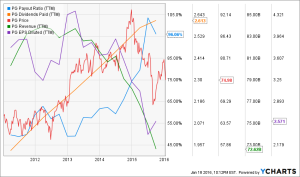

Source: Ycharts

Principle #1: High Dividend Yield Doesn’t Equal High Returns

My first investment principle goes against many income seeking investor rule: I try to avoid most companies with a dividend yield over 5%. Very few investments will be made in my case (you can read my case against high dividend yield here). The reason is simple; when a company pays a high dividend, it’s because the market thinks it’s a risky investment… or that the company has nothing else but a constant cash flow to offer its investors. However, high yield hardly ever comes with dividend growth and this is why I am seeking most.

Source: data from Ycharts.

Procter & Gamble’s dividend yield has always been under the 5% bar where I define the line to consider a “high dividend yield stock”. In fact, the company has been paying a healthy 3%-3.5% yield since 2009. When you combine the dividend growth year after year, you notice the company is able to maintain the same yield. This shows that the stock price is also increasing. PG meets my first principle.

Principle#2: Focus on Dividend Growth

My second investing principle relates to dividend growth as being the most important metric of all. It doesn’t only prove management’s trust in the company’s future but it is also a good sign of a sound business model. Over time, a dividend payment cannot be increased if the company is unable to increase its earnings. Steady earnings can’t be derived from anything else but increasing revenue. Who doesn’t want to own a company that shows rising revenues and earnings?

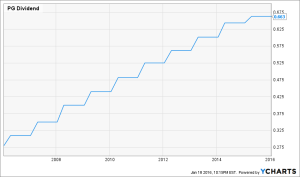

source Ycharts

When you think of a dividend growth stock, PG should be at the top of your list. The company has been paying a dividend for the past 125 years and successfully increased its payment for 59 consecutive years. The company has been increasing its dividend with a CAGR of 7.5% of the past 5 years leading to a dividend payment doubling every 10 years or so.

It is very rare to see such a “perfect dividend stairway”. The dividend is being increased like clockwork for decades now. PG definitely meets my second principle.

Principle #3: Find Sustainable Dividend Growth Stocks

Past dividend growth history is always interesting and tells you a lot about what happened with a company. As investors, we are more concerned about the future than the past. this is why it is important to find companies that will be able to sustain their dividend growth.

Source: data from Ycharts.

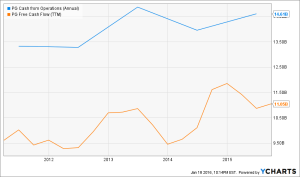

As previously mentioned, the company has gone through major restructuring in both its distribution channels and product offerings. This had affected its earnings (hence the payout ratio) but not its cash flow by much. This is the reason why I find interesting to cross reference both data. The cash dividend payout ratio is more than reasonable at 66%.

PG started to see its productivity efforts paying off in 2015 and it should continue into 2016. The company expects its EPS rising back to original post productivity plan levels in 2016 as the batteries & transitioning beauty businesses is being accounted for as discontinued operations. Therefore, we should see the payout ratio going back to a more acceptable level. PG’s dividend growth is not at risk and it will continue to pursue its path to a 60th consecutive increase. PG meets my third principle.

Principle #4: The Business Model Ensure Future Growth

PG sells consumable products all over the world. Its brand portfolio is more diversified than most mutual funds. With 65 brands and sales in 180 countries, PG owns and masters its economic moat. The short term future comes with its load of uncertainties and challenges.

About 38% of PG’s revenues are coming from developed markets. The global economic slowdown will definitely affect this important revenue segment (in addition to the currency impact). Growth perspectives for 2016 are very limited, but the business is currently working on its profitability during this tough period. The mid term perspectives seem promising as the company will be in a very good position to tap any economic rebound with an enhanced distribution network and a better managed brand portfolio.

What Procter & Gamble does with its cash?

The company’s main focus is to remain a shareholder friendly company. PG intends to buyback shares with 8 to 9 billion dollars and to distribute 7 billion in dividends for 2016. Overall, they expect to return between 15 – 16 billion to shareholders in the upcoming year.

Their focus on cash flow and productivity make such numbers possible. This also shows management’s great confidence in the company’s cash flow generating ability. PG has a solid business model that is designed to generate cash flow month after month ensuring a great stability for dividend payments. PG meets my fourth principle.

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

I think the perfect time to buy stocks is when you have money. Sleeping money is always a bad investment. However, it doesn’t mean that you should buy everything you see because you have some savings put aside. There is valuation work to be done. In order to achieve this task, I will start by looking at how the stock market has valued the stock over the past 10 years by looking at its PE ratio:

Source: data from Ycharts.

I can appreciate the fact that the EPS dropped drastically over the past 2 years considering the business reductions. However, a PE ratio over 22 always seem a high price to pay, even for a top notch dividend grower. It seems here that the company is on the radar of too many income seeking investors and this is why its valuation is going up. I will need to dig deeper to see if the company shows some value at this price…

Using a second method, I will use a double stage dividend discount model. I will use a 9% discount rate as the company shows a very stable and strong business model. As far as dividend growth goes, I will use a 5% for the first 10 years and then 6% afterwards. The reason why I don’t use the past 5 years CAGR of 7.5% is that I believe harsher economic conditions will lead management to be more cautious about their dividend policy. Over time, the modifications they have made will improve the earnings and I think the company can maintain a 6% dividend growth in the future.

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $153.90 | $102.96 | $77.47 |

| 10% Premium | $141.08 | $94.38 | $71.01 |

| Intrinsic Value | $128.25 | $85.80 | $64.56 |

| 10% Discount | $115.43 | $77.22 | $58.10 |

| 20% Discount | $102.60 | $68.64 | $51.65 |

As you can see, the company is currently undervalued by about $10. This is quite interesting even though the PE ratio seems pricy, if you consider the company for what is it; a dividend cash generator, there is still room for the stock to grow. At a 3.5% yield, the company almost looks like a bargain! PG meets my fifth principle.

Principle #6: The Rationale Used to Buy is Also Used to Sell

I’ve found one of the biggest investor’s struggles is to know when to buy and when to sell his holdings. I use a very simple, but very effective rule to overcome my emotions when it is the time to pull the trigger. My investment decisions are motivated by the fact that the company confirms, or not, my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Investment thesis

I think that PG should be at the center of any core dividend growth portfolio. This company shows a perfect combination of diversification and dividend growth potential. This is not an exciting stock, but it is a company that will generate ever increasing distributions in your portfolio.

Out of its 65 brands, 23 generate over $1 billion in sales per year and 14 generate between $500 million and $1 billion in sales. Owning shares of PG is definitely like owning 65 companies at the same time. This is a perfect match for any smaller portfolio you wish to start without taking on too much volatility.

The current stock drop of 16% over the past 12 months and the yield at 3.50% makes it very appealing. The PE ratio is a small concern as this number will greatly drop once 2016 numbers will show the “new lean and improved” business.

Risks

Thinking that PG is a perfect company is being naive. There are still some concerns around the company’s business. For the long haul, it will be a great challenge to show sales growth over 3%. There is a limit to the shampoo, razors and diapers one household can buy throughout the year. Therefore, once all markets are well penetrated, there is little room for more growth.

The other factor to consider is local competition. In many developing markets, we see the arrival of local competitors that makes PG’s life harder to sell and margins smaller at the same time. This is far from being a threat to the business model, but it may be harder to repeat the past 10-15 years of growing revenues while all consumer companies were developing emerging markets.

PG definitely shows a strong investment thesis and meet my sixth investing principle.

Principle #7: Think Core, Think Growth

My investing strategy is divided into two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where I may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

Having both segment helps me to categorize my investments into a “conservative” or “core” section or into the “growth” section. I then know exactly what to expect from it; a steady dividend payment or greater fluctuations with a higher growth potential.

Procter & Gamble is definitely not part of any growth segment (besides the “dividend one”!). I don’t see how the company could crank up its revenues and earnings by double digits for several years in a row. but this doesn’t make it a bad investment. In fact, PG is a perfect candidate for a core dividend growth portfolio. You will earn steady and increasing dividend payments while the company as a whole will remain relatively stable. Short term price slump creates buying opportunities and I believe we are currently in one.

Final Thoughts on PG – Buy, Hold or Sell?

Overall, PG will always remain on the best dividend growth stock list of many investors and there are many reasons why. First, their stellar dividend payment history make a point of buying this company by itself. The impressive brand portfolio and its wide diversification (products and geography wise) makes it a very stable company through time. Most of their products have and will always be bought by households and the company has the ability and the will to follow and initiate any innovations. PG is a buy.

Disclaimer: I hold PG in my DividendStocksRock portfolios.

Disclaimer: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]