This has been an interesting time for markets. China's market crashed, and global markets around the world responded with milder crashes and volatile rides.

And yet the US still has a highly valued market.

According to historical valuation assessments of the broad market, such as the Shiller P/E, the U.S. stock market is still valued at a premium compared to its historical mean. This is probably partially the result of the unusually long stretch of low interest rates. And when discounted cash flow analysis, or other versions of that like the dividend discount model, are performed on individual stocks, many of them have been valued at a premium lately.

Needless to say, I'm not surprised to see a market correction, and wouldn't be surprised to see a bigger one on the way. We're certainly due for one. And yet, I'll still be putting money into the market. This season's newsletter will focus on how to build a dividend portfolio to weather economic storms, including some stock ideas I think look reasonably valued at the moment.

Keys to Defensive, Successful Investing

Investing is simple, but not easy. Many investors buy and sell on emotion, as evidenced by the fact that large cash flows into the market are observed to occur at market peaks, and large cash flows out of the market are observed to occur towards market bottoms. I think that readers of dividend sites like this one tend to do better, fortunately. I'm preaching to the choir a bit in this section.

The healthiest, longest lived populations in the world, such as those living in Okinawa Japan or Icaria Greece, tend to have the simplest, most obvious diets and lifestyles. And most of the world doesn't follow them, despite their simplicity and pleasure. In places like that, the people eat whole fresh food like wild fish and legumes, plenty of vegetables and fruits and herbs and spices, socialize with family and friends as a cultural priority, drink tea or wine in moderation, get plenty of slow exercise from walking to and from their jobs and neighbors homes and doing manual work, and don't rush or experience much stress. And many of them are dancing and hiking and laughing and staying mentally sharp into their 90s and 100s, while spending a fraction of what we do on health care. It's not complicated for them.

Successful investing is a lot like that. Simple, but rare. Obvious, yet rarely followed.

Check your Balance

This is a good time to check your asset balance. Do you have the ratio of stocks, bonds, cash, and other investments that you target?

This is a good time to check your asset balance. Do you have the ratio of stocks, bonds, cash, and other investments that you target?

Having a diversified portfolio reduces volatility because by ocassionally rebalancing, you'll naturally shift money from bonds/cash to stocks when stocks are cheaper, and shift money from stocks to bonds/cash when stocks are expensive, simply due to returning to your target balance from time to time.

Invest Over time

If you determine the suitability of an investment by calculating a fair intrinsic value, don't worry too much about trying to predict the future. If the price is reasonable now, a few months from now might be even better. Or it might be worse. Neither of us know. By putting money into attractively priced investments on a regular basis, you even out your chances.

If you determine the suitability of an investment by calculating a fair intrinsic value, don't worry too much about trying to predict the future. If the price is reasonable now, a few months from now might be even better. Or it might be worse. Neither of us know. By putting money into attractively priced investments on a regular basis, you even out your chances.

There are plenty of people I know that dabble in investing as a hobby rather than as a consistent means of building wealth. What this means is that they maintain a little portfolio of some hot stocks, and enjoy discussing performance with colleagues and friends. Five years later, their portfolios are still small, because individual stock performance is a lot less important than shoveling money into a portfolio month after month.

Stock, Country, and Sector Concentration

Consider how much money you'd be willing to lose in a single investment, and then invest accordingly.

Consider how much money you'd be willing to lose in a single investment, and then invest accordingly.

Regardless of how prudent we may be, an investment could go sour. We don't have access to all the current information, nor do we have the ability to see the future. Plus, a shared event could bring down all stock prices in a sector, such as a reduction in the price of a barrel of oil, or a housing bubble. And a single country could have poor governance or economic stagnation. It's often a good idea to maintain diversification among companies, sectors, and countries.

As long-term investors, we don't really care about stock prices themselves, because all else being equal, low stock prices just mean more buying opportunities. But we do care about tangible financial damage to a company including things that could lead to dividend cuts, so diversification is important.

Concentration into a few companies, or a major sector, could lead to outperformance compared to a diversified portfolio. But it could also lead to disaster, wiping away a decade of portfolio growth. Deep concentration sometimes makes sense for professional investors, but rarely is ideal for casual investors who are building wealth for their families.

Four Stocks to Consider

Texas Instruments (NASDAQ:TXN)

Texas Instruments has fallen from a high of nearly $60 down to under $50 per share, and I believe it may be a solid investment at this price level.

Texas Instruments has fallen from a high of nearly $60 down to under $50 per share, and I believe it may be a solid investment at this price level.

Over the last decade, the company has not had any revenue growth, and a big reason was that they completely exited the wireless market to focus on analog and embedded chips, which was a transition they completed in 2013. Despite the lack of revenue growth, the company has increased free cash flow margins and reduced their share count substantially from share repurchases, resulting in 13% free cash flow per share growth over the last decade. They've also increased their dividend for eleven consecutive years now. All of their free cash flow goes to dividends and share repurchases, and only 4% of revenue has to be invested back into the company for capital expenditures.

Looking forward, with no major transitions ahead, Texas Instruments is the largest analog chipmaker in the world and should be set to finally grow. In addition, their transition from 200mm to 300mm wafers should cut their costs significantly, further increasing their profit margin. As they continue giving all the free cash flows back to shareholders, investors should do well.

An issue that some dividend portfolios face is that they lack much investment in the technology sector. Dividend growth companies are rare in the sector, and as an investing demographic, we tend to prefer stability. A company like Coca-Cola (NYSE:KO) will be selling pretty much the same products ten years from now as they do now, but Apple (NASDAQ:AAPL) will be selling absolutely nothing of what they currently sell in 10 years. A company that has to continually reinvent itself is harder to predict for the long holding periods that dividend investors tend to prefer.

But a handful of tech companies are blue chip companies with decent dividend payouts, and Texas Instruments is one of them. The dividend yield is currently 2.8% with a high dividend growth rate, and the overallshareholder yield is over 7%. Analog chips, which measure things like temperature and pressure and convert them into digital information, are hard to design, have very long product lifecycles (years, and sometimes decades), and as a result offer high profit margins for the designers. Embedded systems, like microcontrollers, also have long lifecycles and similar profitability levels. If there's a tech stock out there that's good enough for a dividend portfolio, the world's largest analog maker is a top contender.

Chipmakers exist in a cyclical industry, and competition is significant, so Texas Instruments is not without risk.

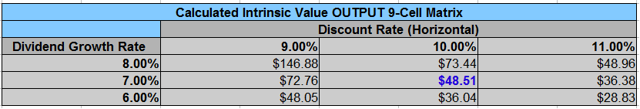

Using the last 12 months of dividends ($1.36), along with a conservative estimate of 7% dividend growth going forward (quite low, compared to their 13% free cash flow growth per share over the past decade and their high recent dividend growth rate), and lastly a slightly market beating 10% target rate of return (discount rate), we can arrive at an estimate of fair value:

For investors that use options, Texas Instruments is also a decent stock to write a long term covered put for. If you want to pick up shares of the company at a lower cost basis than what is currently available, you can write puts at a strike price you desire, and get paid to wait. For example, you can write January 2017 puts at a strike price of $47, and receive about $6 per share as a premium for doing so. If, in the next 16.5 months, Texas Instruments goes below $47/share, you'll have to buy at $47/share, and your actual cost basis would be about $41. On the other hand, if Texas Instruments stays above $47, you'll have been paid a fairly high rate of return simply to wait, without buying, and then you can use your capital elsewhere, or write another put.

Chevron Corporation (NYSE:CVX)

Chevron stock was absolutely slammed and has since rebounded a bit.

Chevron stock was absolutely slammed and has since rebounded a bit.

In my previous newsletter from three months ago, I stated that Chevron stock was fairly valued. Not overvalued or undervalued, but fair. A couple months after I wrote that, crude oil prices dropped like a rock from $60/barrel to $40/barrel, which naturally brought oil stocks down, including Chevron. This is an example of where not putting too much money into one stock, and having a habit of investing money every month, helps ease things a bit. Recently, crude went back up to about $50, easing Chevron's problems.

Chevron is in a particularly vulnerable state, because they have a high dividend payout for the industry, and they're right in the middle of an investment cycle where they are spending a lot of money on investments and waiting for large LNG projects to fully come online and start producing major revenue. Having oil prices fall and their profit cut away, is a major blow to the company.

The big question for dividend investors is whether or not the dividend is safe. The company has raised its dividend for 27 consecutive years and now is being looked at as a potential dividend cut. After this stock price drop, the dividend yield is at a lofty 5.3%.

The official position of the company, based on their most recent investor presentation and words from their chief financial officer during the last earnings announcement, is that their number one priority is to cover the dividend with free cash flow by 2017. This is because their major LNG investments are coming online, and capital expenditures are expected to fall dramatically when their period of massive investment will be finished, and the fruits will be harvested. The next year and a half though, until 2017, will be rough. At these oil prices, free cash flow won't cover the dividend, and so the company is issuing debt to pay for it. Obviously that's not sustainable.

The company currently has about $30 billion in long term debt, and shareholder equity minus goodwill of about $150 billion. This is a LT debt-to-equality ratio of about 20%, which is a very strong balance sheet. The company currently pays out about $8 billion per year in dividends, so if the company uses debt to fund the dividend for 18 months, that would require about $12 billion. This would boost long term debt to $42 billion for the dividend alone, resulting in a LT debt-to-equity ratio of around 30%, which is still a very strong balance sheet. As a comparison, ConocoPhillips (NYSE:COP) currently has a LT debt-to-equity ratio of about 50%. So, Chevron could fuel its dividend with debt until its LNG operations help it fully cover its dividend with free cash flow in 2017, and still have a stronger balance sheet than Conoco Phillips.

Does Chevron have to cut its dividend? Absolutely not. Will they? Who knows. In a world without dividend champion lists, and investors that rely on dividends for income, cutting the dividend for a year or two and then restarting it at a higher rate when they are in a better position, would be financially prudent. But when reputation matters, the executives seem as though they want to hold onto it.

The way I see Chevron currently, is that gas prices won't stay this low forever, and five years from now, Chevron at $80/share or Exxon Mobile at $75/share will be seen as steals. But in the near term, a dividend cut is not out of the question, especially for Chevron. I wouldn't rely on Chevron for current income, but I'd look at it as a potential bargain stock for the long haul.

Toronto-Dominion Bank (NYSE:TD)

The Canadian housing market is highly priced, and Canadians have record levels of household debt relative to disposable income, at over 160%. This is higher than US household debt levels right before the housing crash in the mid-2000s, when we were at 130% on average, down to under 110% now after some household deleveraging.

The Canadian housing market is highly priced, and Canadians have record levels of household debt relative to disposable income, at over 160%. This is higher than US household debt levels right before the housing crash in the mid-2000s, when we were at 130% on average, down to under 110% now after some household deleveraging.

Vancouver is a particularly interesting case, because much of the demand for housing comes from outside their local labor market. A significant chunk of luxury property in the city is purchased by people from mainland China, and many Chinese people just lost a lot of wealth on paper from their stock market crash.

Plus, oil prices have fallen far, and Canada's economy has a lot of concentration in this sector. If there's something that could cause a housing bubble to burst, something like this might do it.

Needless to say, some investors are shorting companies that have exposure to the Canadian housing market. I can see why. And yet, I don't think investors necessarily have to avoid this industry. TD in particular is in a decent position.

The Canadian banking system works in a fundamentally different way than the US banking system. In Canada, it's a lot harder to simply walk away from a mortgage when the price of a house drops. As a result, even before the U.S. housing crash, Canadians have had a much lower rate of mortgage delinquency than Americans. In addition, many residential mortgages held by Canadian banks are insured by the government, limiting their own losses.

Toronto-Dominion bank is one of the largest banks in Canada, and is the sixth largest bank in North America. Their business model involves borrowing money mainly from depositors and lending that money at higher interest rates to customers for mortgages, auto loans, and other types of loans. The bank has expanded strongly into the United States along the east coast, resulting in the bank having 15 million Canadian customers and 8 million American customers and growing. The bank's focus is on retail banking, aiming to offer top-quality customer service compared to competitors. At a time when banking is starting to shift from physical to online banking, TD is going against that trend by focusing on expanding their physical footprint and offering longer banking hours than competitors.

Compared to their peers, TD has a larger portion of their Canadian mortgages insured. Slightly over two-thirds of their Canadian residential mortgages are insured. For that other third, the average mortgage-to-value of the loans is 70%, meaning that a fairly large housing correction would have to occur before those mortgages would be underwater. Unfortunately by some estimates, the Canadian housing market may indeed be that far overvalued, with that far to fall. Overall though, it can be said that TD is in a stronger position than American banks were before the US housing crisis, and is also in a stronger position than many of the other large banks in Canada. The credit agencies currently assign TD bank with high credit ratings (Aa1, AA-, and AA respectively by Moody's, S&P, and DBRS), and those credit agencies are taking into account the risks embedded in the current Canadian housing market.

Historically, TD's performance has been excellent. The company has had 12% average dividend growth over the past 20 years, and currently has a solid 3.8% dividend yield. Over the past 10 years, the bank's revenue has climbed from under 12 billion CAD to over 30 billion CAD, while EPS has grown at a similar rate, despite some share dilution.

Their most recent investor presentation states that the bank expects to increase adjusted EPS by 7%-10% per year over the medium term. In combination with a nearly 4% dividend yield, this is a good potential investment. However, given the state of household debt and housing prices in Canada, I'll use a more conservative growth estimate in my dividend growth expectation.

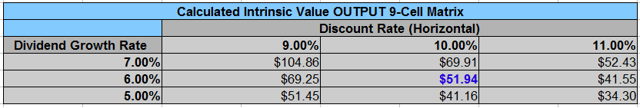

Here's the estimated fair value, in CAD, using a 6% long-term dividend growth rate and a 10% discount rate:

That's in CAD on the TSE, not in USD on the NYSE. Currently, the price is about equal to the estimated fair value. And that's using a dividend growth rate that is below the low end of the company's estimated EPS growth rate; 6% compared to 7%-10%, because I'd prefer to be pessimistic on this. If you believe the company will hit its estimates, or if you're willing to settle for a lower 8% or 9% rate of return, the fair value to you would be substantially higher than the current price.

Overall, I believe TD represents a fair buy at this time. There are risks in the Canadian housing market, but the stock is trading at a price that seems to take that into account. TD has protection in the form insurance for a majority of its residential mortgage portfolio as well as diversification into the US lending market.

Aflac Incorporated (NYSE:AFL)

Aflac sells supplemental health insurance in the United States and Japan. While primary health insurance companies will cover various specific procedures, usually by paying the health care provider rather than the policyholder, Aflac's main business model instead is to pay cash to policyholders that file claims for certain health problems, like cancer. This way, when customers face income loss or other financial problems due to a health problem, Aflac provides them with cash to get through those difficult times while their primary health insurance company covers the actual medical expenses.

Aflac sells supplemental health insurance in the United States and Japan. While primary health insurance companies will cover various specific procedures, usually by paying the health care provider rather than the policyholder, Aflac's main business model instead is to pay cash to policyholders that file claims for certain health problems, like cancer. This way, when customers face income loss or other financial problems due to a health problem, Aflac provides them with cash to get through those difficult times while their primary health insurance company covers the actual medical expenses.

The company experienced strong top line growth between 2005 and 2012, climbing from $14.3 billion in revenue to $25.3 billion in revenue. During that time, the dollar was weakening compared to the yen, giving the company a strong tailwind. Then, from 2012 to now, the revenue has fallen from that height of $25.3 billion to $21.7 billion, this time due to the dollar strengthening compared to the yen, giving the company a major headwind. EPS has followed a similar pattern over that period of time.

So, this has been a tough few years for Aflac. The positive part of the story, however, is that their core business is doing very well when exchange rates are excluded. Between 2005 and 2014, the amount of premiums they have generated in Japan has increased every single year, from about 1 trillion yen in 2005 to about 1.6 trillion yen in 2014. The story is similar for their US business; premiums have increased from $3.7 billion to over $5.6 billion during that period, and every single year saw an increase in premiums compared to the previous year.

Japan has an aging population, and the universal health care system is conservative in its payouts. Japan has the longest life expectancy in the world and pays considerably less than half of what the US pays per capita on health care each year. This gives Aflac plenty of room for continued growth for the forseeable future, because their role as a supplemental insurer should only grow stronger.

The long-term bearishness of Japan's economy, along with their very high national debt, is a risk to be aware of. However, Japan's debt is held in its own currency to its own citizens, giving the country considerable flexibility in avoiding default in most foreseeable scenarios.

Although predicting exchange rates is not something I care to do, the fact that the dollar has already had a four-year surge relative to the yen (going from fewer than 80 yen per dollar in 2012 to over 120 yen per dollar currently in late 2015), and the dollar has surged relative to foreign currencies in general, implies that the company probably doesn't have too much to worry about from continued currency headwinds over the long term, at least. I believe the worst of their currency troubles are probably behind them, and if not, the company is doing fine anyway, albeit with reduced profitability, and they can safely ride out the currency problems.

Aflack stock currently trades for a P/E of just under 10. They have raised their dividend for 32 consecutive years, but their payout ratio is on the low side, and the dividend yield is about 2.7%. They also repurchase a lot of shares, and between 2005 and the current quarter, their total share count has fallen from 508 million to 444 million. This is a business model I like; a large portion of the returns comes from the dividend and from the company reducing its share count by buying cheap shares, while also enjoying moderate premium growth and a growing customer base in two countries.

Aflac's dividend has historically risen at a double-digit rate, but during the recent problem with currency exchange rates, Aflac's dividend growth rate has fallen below 6%. In 2015, the company expects to repurchase $1.3 billion worth of stock, which is 5% of the market cap. The board of directors this past month increased the authorization for the amount that the company can repurchase, up to 56 million shares, or over 12% of the existing number of shares outstanding. Repurchasing the shares is one way to accelerate dividend growth, because reducing the share count allows the company to continue to pay out more and more per share. With shares so cheap, the company gets a good rate of return on their purchases, although I'd like to see a moderately higher dividend payout ratio, personally.

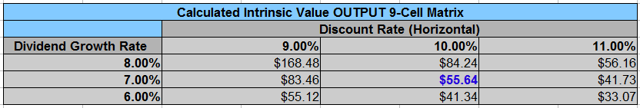

Given historical dividend growth rates, recent growth rates, share repurchase rates, core company performance, and an assumption of reducing currency problems over the next 5 years, I'll use 7% dividend growth as an estimate for the long term. The estimated fair value ends up being around $55:

As you can see, with the fairly low yield, the estimated fair value is very sensitive to adjustments in the estimated dividend growth rate and the discount rate. Overall, with a low P/E, a long history of dividend growth, a modest current dividend yield, and a fairly safe business, I believe Aflac represents a decent purchase at these prices levels, especially with many other stocks being valued at much higher earnings multiples.This article was written by Dividend Monk. If you enjoyed this article, please subscribe to my feed [RSS]